Mark Yaxley | Mar 19th 2024, 2:53:54 pm

This Week's Market UPDATE: STRAIGHT FROM THE VAULT. Keep up-to-date with the economic and socioeconomic factors affecting the price of precious metals with this weekly update from industry expert Mark Yaxley, CEO, Strategic Wealth Preservation.

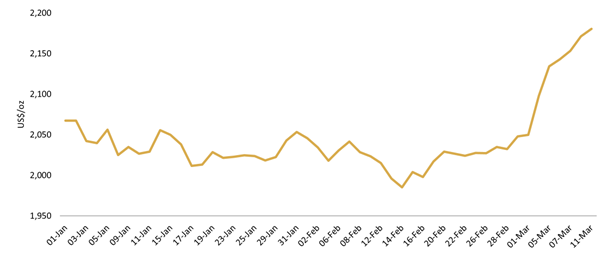

Gold and silver prices remain resilient, trading at USD $2150/oz and $25/oz today, despite a reinvigorated USD this past week. The US Dollar Index (DXY) is at 104 again, up 1% over the past 5 trading sessions.

The US dollar’s strength is the result of better-than-expected economic data coupled with higher than forecast inflation numbers. The Fed committee is meeting this week, but it’s almost certain that we will not see a rate cut. Instead, the Fed is expected to maintain the federal funds rate in a range of 5.25% to 5.5%. They have not achieved their target growth rate of 2%. Instead, inflation remains sticky at 3.2% based on February’s numbers (slightly higher than January’s 3.1%). Inflation in developing nations is still hovering around 10%.

We’re now looking at a more likely scenario where the Fed cuts rates three times this year, leaning towards an initial cut in June.

Ironically, one of the factors keeping gold above the $2100 level is the prospect of rate cuts. Another key factor is the recent surge in stock market volatility. The Wall Street Journal recently referred to the stock market as the "world's biggest casino right now." It was referring specifically to the frenzy created by AI stocks and semiconductor producers like Nvidia. The recent spike in volatility makes gold an attractive hedge play.

Official gold reserves in China have now risen for 16 consecutive months with the addition of 12 tonnes in February, pushing their total holdings to 2,257 tonnes – 4.3% of the country’s foreign exchange reserves.

Chinese investor’s demand for gold also remains strong. Chinese gold ETFs saw their third consecutive net monthly inflow, amounting to US$109M, pushing their total assets under management (AUM) to another record high of US$4.3B.

ETFs in North America and Europe, however, both experienced net outflows in February.

Price of Gold Since January 1, 2024*

*As of 11 March 2024.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Market Update April 23 – Metal Rally Pauses for Air | Apr 23, 2024

Market Update April 16 – Global Volatility Has Investors Worried | Apr 17, 2024

Market Update April 9 – Gold and Silver Rally Continues | Apr 9, 2024