Mark Yaxley | Mar 26th 2024, 2:17:27 pm

This Week's Market UPDATE: STRAIGHT FROM THE VAULT. Keep up-to-date with the economic and socioeconomic factors affecting the price of precious metals with this weekly update from industry expert Mark Yaxley, CEO, Strategic Wealth Preservation.

Gold reached $2200/oz for the second time within a week, marking a significant milestone for investors. This price point, which is just shy of the all-time high of $2220/oz, carries considerable psychological weight. Gold has demonstrated its resilience amidst renewed tensions in the Middle East, as well as in the aftermath of terrorist attacks in Russia. What's noteworthy is that gold continues to trade strongly despite the US Dollar's value being above 104 on the DXY index. The coexistence of a strong gold market and a high dollar value is uncommon, as gold, being priced in US dollars, typically struggles when the dollar is strong.

Despite gold's strength, there's considerable attention on silver as the potential trade. One ounce of silver currently stands at $25, but it has yet to reach the price levels that some investors anticipated, especially considering gold's recent success. This has brought the gold/silver ratio into focus, which remains high in the 86-90 range compared to its 5-year average of 83. As a result, a gold/silver swap has become appealing to those looking to capitalize on silver's relative weakness compared to gold.

Several factors support the case for silver:

1) Indian silver bullion imports surged to a record monthly level in February, accounting for a substantial portion of total 2023 imports, indicating strong demand in a key market.

2) Silver entered a structural deficit in 2021 due to increased demand from industries such as photovoltaics and automotive. This has led to deficits averaging 250 million oz annually over the past three years. Inventories at major exchanges like LBMA, COMEX, and SGE are dwindling, suggesting tightening supply conditions.

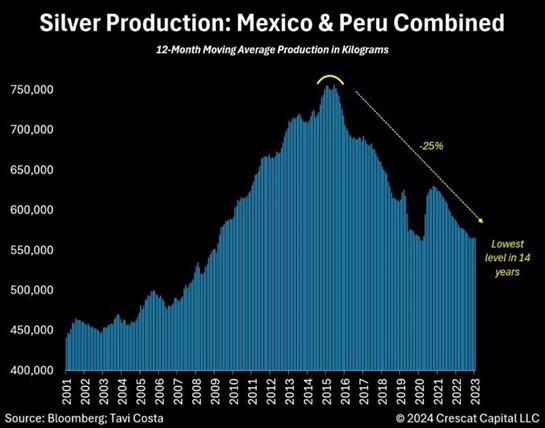

3) Production data from Mexico and Peru, the world's top silver producers, reveals a significant decline compared to 2016 levels. Mexico & Peru together are producing 25% less vs 2016 levels, helping drive the drawdown in above ground stocks as a substitute.

Taken together, these factors suggest that silver may present an attractive opportunity for investors, particularly given its potential to catch up to gold's recent performance and the underlying supply-demand dynamics in the market.

Source: MKS PAMP, Metals Focus, Bloomberg, Crescat Capital

Market Update April 23 – Metal Rally Pauses for Air | Apr 23, 2024

Market Update April 16 – Global Volatility Has Investors Worried | Apr 17, 2024

Market Update April 9 – Gold and Silver Rally Continues | Apr 9, 2024